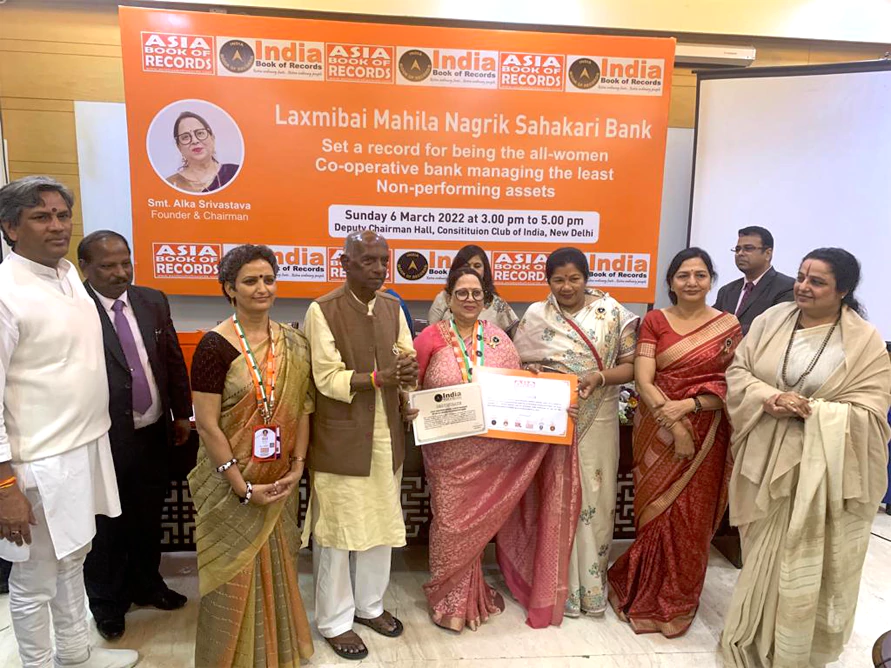

Least NPA managed by an all-women bank

Least NPA managed by an all-women bank

It was no coincidence that the name of an all-women bank, Laxmibai Mahila Nagrik Sahakari Bank Maryadit, Gwalior, Madhya Pradesh, which was in the news all over the country for having zero NPA (Non-Performing Assets) recently, got featured in the India Book of Records. Since the inception of the bank in the year 1997, Ms. Alka Srivastava, founder and chairperson of the bank, had a definite vision to take the bank to the new heights just by following her principles. The lower- and middle-class women, whose money was deposited in this bank, took out their hard-earned money from all the possible corners of their sari pallu, rice box, kitchen corner and cupboard drawers in order to hand-over to the bank. The pain and hard work of those women could be seen in their eyes.

Ms Alka set up the bank with the help of these very deposits with a valid license from Reserve Bank of India (RBI). In its journey of 25 years this bank has been profitable since the beginning. The bank for women and run by women made its members partners-in-profit through timely distribution of the dividend earned. It is this thought that kept the bank on the path of progress. The second branch of the bank is at Dabra in Gwalior district and it has a total of 26 employees, all women.

Relentless efforts were made to achieve zero NPA level. The founders keep a close eye on each and every loan, meeting every woman personally who is seeking a loan. All the guarantors are warned that they will have to fulfill the obligation of taking the guarantee of every rupee of the loan. Before giving the loan, the bank personnel visit each beneficiary’s home or work place, note down all the details, and inquire with the people in the neighborhood about the nature of the loan seeker. After satisfaction, the loan is disbursed as per the rules of RBI and in accordance with the decision of the committee. Ms Alka says, “I myself maintain a register, in which the details of the borrower are kept for the entire month. Those whose three installments are pending, a separate list is prepared and given to the loan officer for recovery.

She recalls, “Once a woman beneficiary fell sick with TB and her installments stopped coming. She had three daughters and some anti-social elements used to intimidate our bank employees. In such a situation, I myself went to her house, took her along to the municipal office in a car. There she got her subsidy cheque and thus we saved the bank.”

Sometimes there are cases of subsidy of some women, sent to the bank by the Municipal Corporation or the Industries Department, which are also given loans after thorough investigation. If the subsidy is not received on time, then instead of troubling the beneficiary, the bank contacts the department and helps the beneficiary. The NPA of the bank has been zero due to identifying the right persons, checking all their documents, and giving loans only for genuine work.

Ms Alka, a graduate from the Lucknow University, has been honoured with many awards for her sincere social service. She believes that when the bank is in profit, it grows well, money keeps on accumulating, with zero NPA, only then the bank will be able to help needy women who are entitled for the loan. A befitting all-women bank has successfully made its record with India and Asia Books of Records.